Table of Content

- LICHFL Home Loan Interest Rate 2022

- Home Loan Calculator by Top Banks

- LIC HFL Interest Rate for Existing Customers

- Apply Here For LIC Home Loan In Lucknow

- Balance Transfer Scheme

- LIC HFL Home Loan Interest Rates

- What Should You Do if the RLLR-based Home Loan Rate of Your Bank is Higher than the Prevailing Market Rate?

I had applied the loan amount of Rs. 17 lakhs and i have chosen the tenure period of 10 years. Totally, i'm satisfied with the loan service provided by LIC. I have taken a home loan, going with LIC Housing Finance. Rate of interest 8.5% and processing fee of 4500 rupees are nominal. They have sanctioned a loan on time within 2 days completed the process.

Upon payment through netbanking, payment summary will be shown. The current home loan interest rate on LIC housing finance ranges from 8.30% p.a. Both Salaried and Self-employed individuals can opt for this facility in a hassle-free manner. To opt for this facility, your CIBIL score must be good . The Balance Transfer Interest rates depend on your outstanding loan amount and it may be different for salaried and self-employed individuals. Currently, the balance transfer rates range from 8.30% - 9.90%.

LICHFL Home Loan Interest Rate 2022

However, the final rate offered to you is solely at the bank’s discretion. NRI house loan scheme for land purchase, home improvement/renovation, top-up home loans, and balance transfer of the existing home loans from other banks or NBFCs to LIC Housing Finance. HDFC people guided to take Pradhan Mantri scheme for the home loan.

I applied through bank executive and loan disbursement done with in a week. My home loan was taken from LIC Housing because their processing time and charges are less but interest rate is little bit high when i compared to other Government banks. They have taken 1 week to sanctioned the loan. Documentation process is as usual like other banks. They have provided me a interest rate of 8.45%. LIC Housing Finance Limited also known as LICHFL is a housing finance company that operates in the country.

Home Loan Calculator by Top Banks

Apply at existing bank – A good understanding with the bank help you avail a high loan amount and that too at competitive rate of interest on your home loan without any hassle. The loan amount primarily depends on the CIBIL score of the borrower. However, the maximum amount that a government employee can apply for is equal to his basic pay for 34 months. Your 2 EMIs waived off at the closure of loan or at the end of a 5 years tenure, if you has zero deafult and didn’t make prepayment in the initial 5 year repayment period. Struggling to pay your existing higher home loan EMI amount because of the higher interest rates? Well, you can easily opt for the LIC HFL Home Loan Balance Transfer Facility at a lower interest rate.

From LIC Housing Finance, i have taken a home Loan because the document submission is very less where in other bank, there are lots of documentation process. They have sanctioned the loan within 1 month . The total tenure period was 20 years and the rate of interest was 8.8% which is good. Calculate your EMI amount beforehand with the help of BankBazaar LICHFL Home Loan EMI Calculator.

LIC HFL Interest Rate for Existing Customers

However, such offers don’t last forever as they are valid for a specific period. So, if your home loan rate is quite high and you see a lender giving you the balance transfer facility at a lower rate, grab it at the earliest. If that comes with a fee waiver too, you will only gain more from this transaction.

I have taken home loan directly through LIC Housing Finance Ltd. From LIC, they offered a home loan and the loan amount was Rs. 27,00,000. The rate of interest was high 9.15% with the duration period of 20 years and i am paying EMI of Rs.24,000 and they given this loan very faster . LIC HFL offers a variety of home loan schemes for salaried and self-employed individuals. Listed below are all the home loan schemes which can be availed by the customers. LIC also offers schemes for purchase of plot, commercial property, etc.

The RBI had, in an off-cycle MPC meeting decided to increase interest rates by 40 bps to 4.40 per cent due to rise in inflation. An increase in repo rates signify increasing loan and EMI rates. This was the first-rate hike since August 2018 and the first instance of the MPC making an unscheduled increase in the repo rate. Accordingly, LICHFL has revised its rates of interest upwards across retail loan product categories,” it said. During the term of loan, a LIC HFL home loan borrower gets option of switching from Floating interest rate to Semi Fixed or Full Term Fixed rate based on market conditions or his/her financial planning. Various Builder/Developer who have advertised their products.

The amount was sanctioned of 25L and subsidiary amount of 2.67L. Pre closure is applicable with nominal charge. The process was good hence they have sanctioned the loan within 20 days. I have taken home loan directly through Tamilnad Mercantile Bank.The rate of interest and the processing fee was high .This loan was sanctioned on time and i have uploaded the documents through online . The service was average according to my concern.

He has more than a decade’s experience working with media and publishing companies to help them build expert-led content and establish editorial teams. At Forbes Advisor, he is determined to help readers declutter complex financial jargons and do his bit for India's financial literacy. Keep all property related documents – It is very important to maintain and keep all the property documents with you.

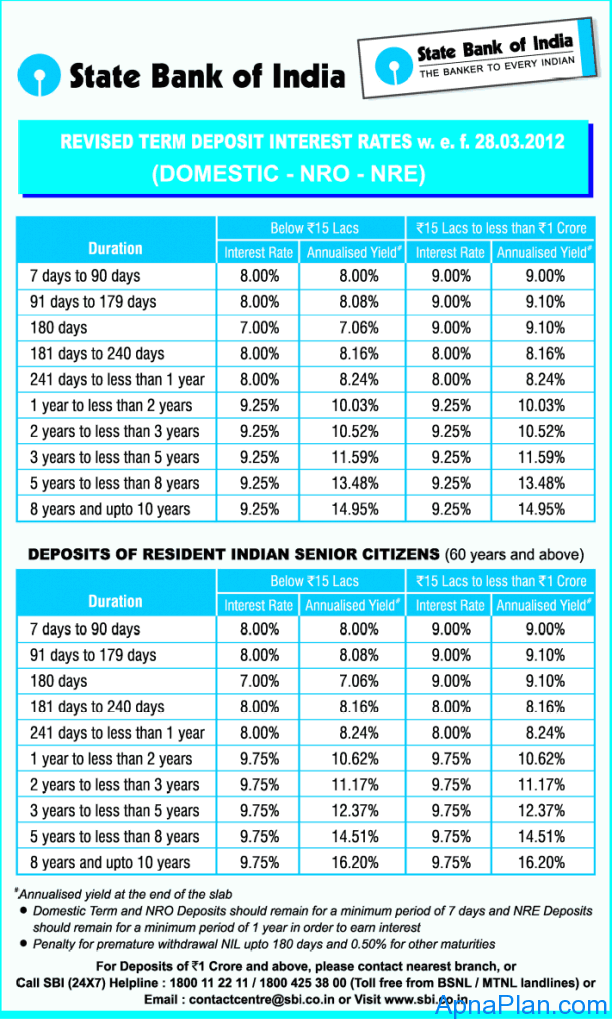

Your credit history and credit score is also helpful in getting desired home loan interest rates. Here are the interest rates offered by top banks in India. The interest rate on LIC home loans depends on a lot of factors including the CIBIL score of the applicant, monthly income, existing loans, etc.

So, it’s advised that you compare LIC Vs HDFC home loans thoroughly before cashing in on one. LIC Housing Finance Limited offers home loans starting at 8.00% p.a. I have taken a home loan from LIC HOUSING FINANCE on 3 years back to purchase site and for construction my friend has suggested to take this loan. I got loan the loan amount around 27L with tenure period of 20 years. The rate of interest was 8.75% and processing fee was deducted around 8K.

You can easily transfer the home loan LIC if you see that it offers a lower interest rate than other banks. Also, a balance transfer can be done if you are not happy with the bank's customer service. LIC Housing Finance charges minimal processing fees on home loans. The processing fee is non-refundable, and it is not included in the home loan amount. For example, if the home loan amount is Rs 20 lakh, you will have to pay Rs 10,000 as processing fees, Which is 0.50% of Rs 20 lakh.

In this type of home loan scheme, the EMI is low, and you can avail of the loan within no time with minimal documentation. Yes, if another bank is offering you a lower rate of interest on your existing home loan, then you can opt for a home loan balance transfer. However, it is important to check with your bank whether it offers a home loan balance transfer facility or not. Below is the table showing the interest rates and processing fee of home loans offered by several lenders. I got the good interest rate of 8.5% from the LIC housing with minimal documents. Overall process also very fast and good so i have chosen this bank.

Will I get 100% property value as a home loan from LIC? LIC offers home loan of up to 90% of property value for loans of up to Rs.30 lakh, 80% of property value for loans between Rs.30 lakh and Rs.75 lakh, and 75% of property value for loans exceeding Rs.75 lakh. Central Bank of India offers home loans with multiple names, here we are covering the Cent Home Loan. It is given to purchase land for construction of house, purchase, construct a new house, purchase an old house, flat . In India, home loans are provided to people looking for credit to purchase homes and is a market with huge potential.

No comments:

Post a Comment