Table of Content

To find the lowest VA rate for your new loan, you’ll have to apply with multiple lenders and compare their offers. That might sound like a lot of work, but it’s possible to rate shop in under a day if you set your mind to it. Since VA mortgage rates are set by individual lenders, rather than the VA itself, there can be a wide range across the market. But the lender from which you’re borrowing will have its own set of guidelines. Although they’re backed by the federal government, VA loans are offered by private lenders.

An easy way to find out if you’re eligible for a VA loan is to ask the VA for a certificate of eligibility . Or, if you’re not big on paperwork, most lenders will do this for you in just a few minutes. If none of these apply to you, Veterans United is likely not the right company for your home purchase or refinance. Veterans United does offer other types of government-backed home loans. But its focus is clearly on VA loan benefits and providing the best service possible to U.S. military personnel. Veterans United is a top performer for VA mortgages, with competitive rates and top-rated customer service.

Veterans United Home Loans variety of loan types

We’ve determined the national averages for mortgage and refinance rates from our most recent survey of the nation’s largest refinance lenders. Our own mortgage and refinance rates are calculated at the close of the business day, and include annual percentage rates and/or annual percentage yields. The rate averages tend to be volatile, and are intended to help consumers identify day-to-day movement.

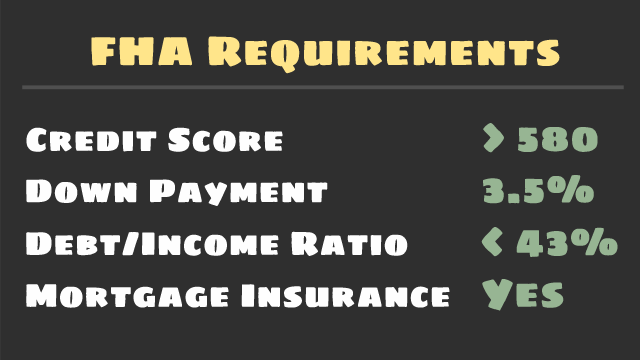

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan terms, interest rate types , down payment size, home location and loan size will all affect mortgage rates offered to individual home shoppers. Mortgage insurance costs up to 1% of your home loan’s value per year. Borrowers with conventional loans can avoid private mortgage insurance by making a 20% down payment or reaching 20% home equity.

From mortgage calculator to your dream home

Your personal mortgage expert will support you to review and understand all your options. Together with our team of experienced brokers, you will understand the nuances of your situation and fine-tune your mortgage decision. Our engine combines modern finance theory with practical insights from our team of mortgage brokers. The mortgage approval is a binding document which certifies that your lender will support you with the funding. Getting a German mortgage pre-approval will help you stand out from other potential homebuyers.

However, our calculator does not replace a personal consultation. Use the calculator to understand your mortgage repayment options. Once the mortgage lender has received the required payment order documents, they will pay out the loan. Our advanced technology compares mortgage options from over 400 German lender and our mortgage experts will explain each offer. You can calculate the annualized interest by multiplying the current mortgage balance by the annualized interest. You can then convert the result into a percentage by multiplying it by 100.

Mortgage-related complaints at major lenders

Rate locks are an essential part of the mortgage process, as mortgage rates often fluctuate daily. VA refinance rates are often different than rates on VA purchase loans. The type of VA refinance loan, the borrower's credit score, the loan-to-value ratio, and other factors can all play a role in VA refinance rates. Fixed interest rateThe longer you fix the interest rate, the more security you have in planning your mortgage loan. However, you also have to accept higher costs, because the longer the fixed interest rate, the higher the interest rate that the bank will call.

They are available to current or former members of the military, and can be a great option for borrowers who qualify. Compared to other types of loans, VA mortgages are especially accessible since they don’t require a down payment or mortgage insurance. By comparison, other low-down payment loans typically require mortgage insurance if the borrower puts down less than 20 percent. There are many companies online that rank lenders offering VA loans, nationally and in your local area, and provide daily interest rates information. Alternatively, you can work with a mortgage broker that specializes in helping veterans and active-duty military.

If your credit score is too low to qualify for a mortgage , you can work one-on-one with a credit consultant from Veterans United. They will suggest strategies — such as how to prioritize debt repayment from installment loans and credit cards — to get your finances back on track and rebuild your score quickly. For Bankrate’s overnight averages, APRs and rates are based on no existing relationship or automatic payments. Veterans United Home Loans displays current purchase and refinance rates for each VA loan product online, and updates these daily. For a personalized rate, you can fill out a form online with information about your military service, living situation, what loan you’re looking for and contact info. On average, VA loan rates are typically lower than both FHA and conventional mortgage rates.

The average rate on a 30-year fixed-rate mortgage was 6.31% for the week ending December 15, according to Freddie Mac. The rate decreased by 0.02 percentage points compared to a week ago. The average rate for a 15-year fixed-rate loan decreased as well, moving down by 0.13 percentage points to 5.54%. The purpose of an APR is to give you a better overall understanding of what you’re paying. Under the Federal Truth in Lending Act, each consumer loan agreement must also disclose the APR. In addition, lenders must follow the same rules to ensure the accuracy of the APR and to compare certain loan costs using the APR.

You also have the option to buy a single-family home or a qualifying multifamily property with up to four units. Join forces with a distinguished panel of former senior enlisted leaders. These experts help educate Veterans on their VA home loan benefits and the perks of working with Veterans United.

Typically, banks lower the interest rate gradually in 5% steps of the LTV. In other words, a higher down payment means a lower LTV and a lower interest rate, and vice versa, a lower down payment means a higher interest rate due to a higher LTV. After entering this data into the German mortgage calculator, we calculate the estimated loan amount, interest rate, and monthly repayment rate. A fixation period which is too short could cause you financial hardship if interest rates go up significantly in the future. However, too long a fixation period could result in high costs, inflexibility, or exorbitant cancellation fees if you move on early.

Because the federal government backs VA home loans, lenders have the luxury of charging competitively low interest rates. Eligible veterans and service members find that rates are generally lower with a VA home loan than a conventional mortgage. Aside from the real estate agent fees, additional purchase costs are usually paid only by the buyer. We compare the best mortgage rates in Germany for the top 750 lenders.

Instead, in order to free up money to keep originating more loans, lenders sell their mortgages to entities like Freddie Mac and Fannie Mae. These mortgages are then packaged into what are called mortgage-backed securities and sold to investors. Investors will only buy if they can earn a bit more than they can on the government notes. Borrowers often mix up interest rates and annual percentage rates . That’s understandable since both rates refer to how much you’ll pay for the loan. The current rate for a 15-year fixed-rate mortgage is 5.54%, a decrease of 0.13 percentage points week-over-week.

No comments:

Post a Comment